Growth recovery, declining births, and rising power demand

* BusinessWorld August 15, 2022.

--------------

This piece will cover six topics and events that occurred last week so we go straight to them.

1. GROWTH RECOVERY AND RISING INFLATION

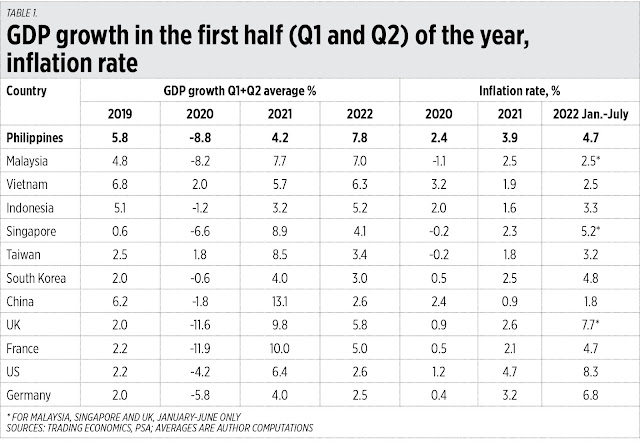

Last week, the Philippine Statistics Authority (PSA) released the 2nd quarter (Q2) 2022 GDP growth and it was 7.4%, a bit lower than the Q1 growth of 8.2%. The PSA also released the July 2022 inflation rate last week and it was 6.4%, a bit higher than June’s inflation of 6.1%.

So, for Table 1, I averaged the GDP growth for Q1 and Q2 of selected countries and compared them with the Philippines’. Then I also averaged the inflation rate from January to July. The big East Asian economies with no Q2 GDP report yet, like Japan and Thailand, are not included in the table.

The Philippines so far has the fastest growth recovery in first half 2022 with 7.8%, followed by Malaysia and Vietnam. The main explanation is low base effect — the Philippines had the deepest GDP contraction in Asia in 2020, followed by low growth in 2021, so high growth in 2022 is just trying to recover and slightly surpass the 2019 GDP size and level.

The Philippines inflation for January-July is 4.7%, within the inflation target of 4.5%-5.5% set by the Development Budget Coordination Committee (DBCC) or the economic team (Table 1). If GDP growth in the second half of 2022 is sustained at 7-8%, this column projects a full year inflation of 5-5.2%.

The DBCC growth target of 6.5%-7.5% in 2022 is attainable — and we will likely surpass it. The growth target from 2023-2028 of 6.5%-8% is also attainable and something that we should work collectively for. Fast growth automatically tempers inflation via a higher supply of goods and services in the economy.

Notice Europe and the US, their deep contraction in 2020 and anemic growth after, coupled with high inflation this year. Stagflation is becoming more real for them. Many businesses there will consider migrating to Asia, including the Philippines.

The Philippines just enacted many market-oriented reforms: the corporate income tax cut under the CREATE law, the liberalization of the Public Service Act, the Foreign Investment Act, the Retail Trade Liberalization Act, dynamic Public Private Partnership (PPP), and there are no planned major tax hikes on the horizon. These are good attractions for those foreign businesses to come in, and for those already here to stay put....

3. RISING POWER DEMAND

Also last week, the Independent Electricity Market Operator of the Philippines (IEMOP) held a media briefing which I attended. Among the highlights of the August briefing were:

One, rising peak demand in the Luzon-Visayas grids was 13,450 MW in 2019, 13,752 MW in 2021, 14,380 MW in 2022. This implies growth recovery.

Two, a rise in power reserves led to a lower price of P6.84/kwh in the August billing vs. P8.92 in June and P8.51 in the May billing.

And three, a rising share of coal power, a declining share of natural gas and intermittent renewables (Table 3).

The forced transition to “decarbonization” and to more intermittent renewables, and less coal power is dangerous. It can lead to more blackouts in the future and businesses will not come in or stay if they have to buy big gensets, meaning higher production cost and less profit for them. The dirtiest and most dangerous energy sources are candles and gensets, not coal. More candles mean more fires and destruction of property. More gensets mean more air and noise pollution. Dark streets at night mean more road accidents and more crime....

Comments

Post a Comment