Motorcycle taxis, illicit tobacco, and electric cooperatives

* My article in BusinessWorld last August 8.

--------------

There were four economic developments last week that I want to comment on...

TOBACCO TAXES AND ILLICIT TRADE

Last week, Budget Secretary Amenah F. Pangandaman reiterated that they will submit Budget 2023 to Congress on Aug. 22. The thick documents include projected tax revenues and other measures to fund the government’s huge expenditures, including sin taxes.

Eight years ago, now Finance Secretary Benjamin Diokno wrote a column, “Illicit trading of cigarettes rising” (Manila Speak, Oct. 9, 2014; reprinted in one of his four books, Through the Looking Glass, published 2020). He cited Oxford Economics’ estimates of tax losses from illicit cigarettes: P2.62 billion in 2012, and P15.60 billion in 2013. The estimated number of illicit cigarettes was 6.4 billion sticks in 2012 and 19.1 billion sticks in 2013, an almost 200% increase in just one year.

Last April, I attended a webinar organized by the National Tobacco Administration on illicit tobacco and Congressman Jericho “Koko” Nograles was one of the speakers. He shared Euromonitor’s estimates of illicit tobacco as a share of total supply: Nationwide 13%, Zambales 11.5%, Nueva Ecija 22%, Bataan 32%, Palawan 25%, Sultan Kudarat 36%, Zamboanga de Sibugay 51%, Misamis Occidental 57%, some areas of Mindanao up to 60%.

Mr. Nograles’ estimate of foregone revenues from illicit tobacco nationwide is P26 billion/year. In March 2021, Congressman Joey Salceda released his estimate of tax losses from illicit tobacco at P30 billion/year. These are huge amounts that benefit the smugglers, and criminal gangs in cahoots with some corrupt government officials, both national and local.

To verify the numbers of the two legislators, I made my own estimate, taking off from the Euromonitor estimate of 13% illicit cigarette share to total supply, meaning 87% is legal tobacco. The numbers I got range from P24 to P49 billion in 2021 alone (Table 2).

High inflation contribution of ABT (Table 1) is mainly due to the steadily rising tobacco tax: P50/pack in 2020, P55 in 2021, P60 in 2022, and 5% yearly increase starting 2023. It is safe to assume that illicit tobacco will only increase, not decrease. With cheap smuggled tobacco, there will be more smoking, not less. And there will be more money for the criminal gangs and their partner corrupt government officials, not less.

ELECTRIC COOPERATIVES AND BLACKOUT ECONOMICS

Last week, Senator Raffy Tulfo, Chairman of the Senate Committee on Energy, lambasted a number of electric cooperatives (ECs) in the country for the frequent blackouts in their franchise area. I also saw these reports in BusinessWorld: “ERC orders 3 electric cooperatives to refund nearly P294M” (May 31), “Gov’t imposes sanctions on two electric cooperatives” (June 9), and, “Tulfo threatens to summon officials of inefficient power co-ops before Senate Energy Committee” (Aug. 3).

Report number one is about Central Negros EC (Ceneco), Pangasinan I EC (Panelco I), and La Union EC (Lueco) that over-charged their customers.

Report number two is about Maguindanao EC (Magelco) and Lanao del Sur EC (Lasureco) that owe P16.7 billion to the Power Sector Assets and Liabilities Management Corp. (PSALM), a government corporation under the Department of Finance. Magelco owes P3.8 billion, Lasureco owes P12.9 billion and they have not expressed the intention to pay. So, taxpayers have shouldered their unpaid debt -— very wasteful and corrupt.

Report number three is about frequent brownouts in EC areas in provinces including Palawan, Bataan, and Davao. Later Oriental Mindoro EC was also investigated.

Five years ago, I wrote in this column, “Unstable power supply due to problematic electric cooperatives” (BusinessWorld, Feb. 8, 2017), about the Abra Electric Cooperative (ABRECO) and Albay Electric Cooperative (ALECO) that owed big amounts to the Wholesale Electricity Spot Market (WESM).

ALECO, in particular, owed P1 billion to WESM around 2010, it also owed PSALM about P2 billion. In 2014, SMC Global bought ALECO and renamed it Albay Power and Energy Corp. (APEC), and assumed its P4 billion debt. Two years later, the debt ballooned to P5.6 billion. Until now, ALECO or APEC still owe some gencos hundreds of millions of pesos.

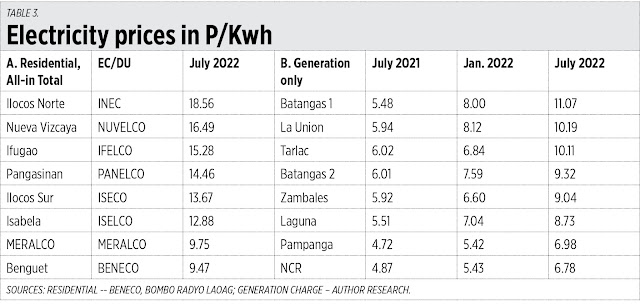

Many ECs are notorious for inefficiency, frequent blackouts and/or high electricity rates that penalize their customers. See some of those ECs and compare their rates with Meralco and the National Capital Region (Table 3).

I am sure Energy Secretary Raphael “Popo” Lotilla is doing something to address the twin problems of blackout economics and the fiscal burden of unpaid debt to PSALM and gencos by many ECs.

Finally, during the Philex Mining Corp. Stockrights Offering last week, Finance Secretary Ben Diokno, as Keynote Speaker, reiterated his support for the mining sector, especially Philex’s new gold mining project in Surigao. Metal prices can only go up, not down, as global demand for gold, copper, silver, nickel, etc. keep rising. The current high excise tax for mining output means higher revenues for the government while allowing the companies to export more and create more jobs. Good policy, Secretary Diokno.

Comments

Post a Comment